A Closer Look At The Impact of Past Geopolitical Events. By Laetitia Peterson.

As the Russia-Ukraine crisis is unfolding, it is understandable that many of us are worried about the impact of the invasion on the rest of Europe and the global economy. The conflict has also caused increased volatility in global share markets which were already unsettled by fears of increasing interest rates and rising inflation.

This current wave of negative news may feel worse than what we have experienced in the past and many of us may fear the situation may get worse. This feeling is coined the “recency bias” in behavioural psychology.

Recency bias is a cognitive bias that favours recent events over historic ones. As a memory bias, it gives "greater importance to the most recent event".

Yet, geopolitical events are not uncommon. Since World War 2 and the Pearl Harbour attack in 1941, there have been tens of similarly worrying events.

In times of uncertainty, it is useful to gain perspective from how the world coped and recovered from similar past events. A good benchmark is the US S&P 500 index. In the table below are listed major market shock events in the last 80 years and their impact on the day and during the length of the different crises. While there is some variation in the impact, the average drop in the S&P 500 index on the day of the event, was just over one per cent and the average drop was just under five per cent for the duration of the crises (see the table below).

When we do risk tolerance testing with clients, most say they can cope with a drop in their investment portfolios of 10 per cent during a calendar quarter. This shows that most of us think we are pretty resilient when it comes to our ability to rationalise and endure the impact of major shocks. It is good to remind ourselves of this when we are going through uncertain times. So, whilst there is no denying that the current invasion of Ukraine by Russia is an horrific event and it is unclear what the resolution will be at this stage, our strong belief in the ability of the aggregate of all market participants to adapt to change, based on how we have adapted to historical events in the past, is a great comfort during uncertain times.

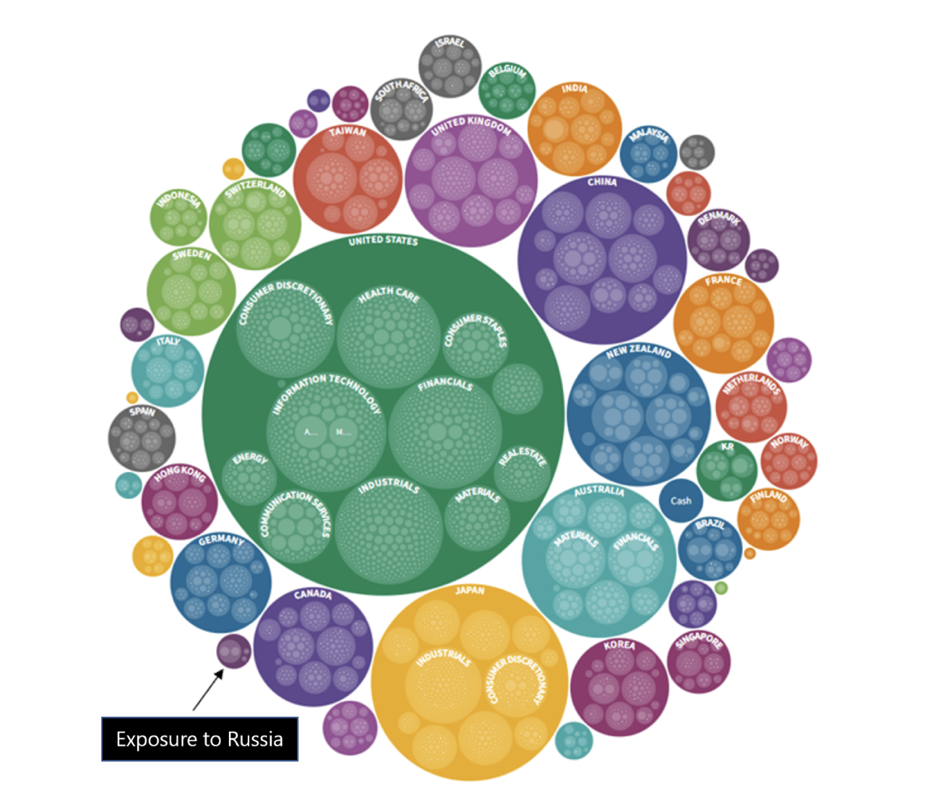

Another perspective which is helpful to calm the nerves is to look at the make-up of a typical globally diversified and market weighted portfolio.

Our investment portfolios are widely diversified and our allocation to Russia and Ukraine is through Emerging Markets (as opposed to Developed Markets) funds. Depending on the overall risk allocation (from low risk to high risk), our portfolios’ allocation to Russia ranges from 0.1% for low-risk portfolios to 0.3% for high growth or aggressive portfolios. Our Socially Responsible Investment portfolios only have 0.1% exposure to Russia across the different risk allocations. We have no direct exposure to Ukraine and Belarus. The geographical diversification of our growth portfolios is graphically illustrated below.

Current events have shown once again the importance of being globally diversified. Whilst we can’t eliminate market risk, having a low cost globally diversified portfolio and a risk allocation to match your risk tolerance and need to take risks to achieve your financial goals, is the best tool in our arsenal as independent financial advisers.