Consilium Investment Strategy & Analysis

Consilium’s Investment Committee is a team of dedicated investment specialists with the responsibility of applying our clear investment philosophy to everything we do.

The Investment Committee meets regularly to research, monitor and report on investments that may be appropriate for inclusion in client portfolios.

Consilium provides advisers with all of the research, asset allocation and modelling tools necessary to deliver high quality investment advice.

Investment Philosophy

Consilium’s investment philosophy is based on four cornerstones:

o Minimising costs is critical

o Focusing only on highly liquid, highly diversified and high quality investments

o Tilting portfolios towards academically proven sources of higher expected returns

o Avoiding expensive tactical trading strategies

The future is unknowable. Chasing the short term ‘promise’ of better returns from high cost, active managers only leads to long term disappointment.

CEFEX Accreditation

The strength of Consilium’s investment processes are such that we have been independently certified by the Centre for Fiduciary Excellence (CEFEX) as achieving global best practice standards.

Consilium’s investment management practices are annually audited by CEFEX to ensure that our processes and procedures remain robust and are being consistently and rigorously applied.

Investment Portfolios

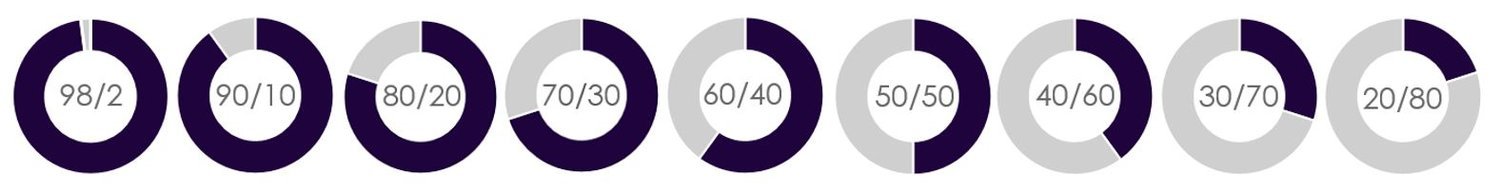

Consilium provides model investment portfolios to advisers who want the ability to deliver a range of different expected risk and return outcomes to clients.

Portfolios are constructed following a strategic asset allocation process, where every major allocation decision is subjected to a detailed review.

A wide range of additional information is available in support of these model portfolios, including historical return and standard deviation data.

The Private Office | External Investment Committee

Damon O'Brien

Chief Investment Officer

Damon is a CFA® charterholder. Damon’s career path has included exposure to a boutique wealth management firm, a national advisory dealer group and a ‘fund of hedge funds’ company. Working in these differing businesses has provided him with a unique perspective across the wider investment and advisory industry in New Zealand.

Damon is the chair of the Consilium investment committee.

He has a B Comm. majoring in Economics and Operations Research from University of Canterbury and, after joining the wealth management industry, went on to complete a Post Graduate Diploma in Business Studies (Personal Financial Planning) through Massey University. As a CFA® charterholder, Damon is bound by the CFA Institute’s Code of Ethics and Standards of Professional Conduct.

Mitchell Bristow

Senior Investment Analyst

Mitchell returned to New Zealand after a number of years working in Hong Kong as a Quantitative Analyst and Risk Manager for funds across a broad range of investment strategies. Mitchell’s professional career has focused on financial modelling and data analysis, with significant experience in tracking, monitoring and reporting on the performance of recommended investments.

In his role at Consilium, Mitchell is an integral part of the investment committee, with a range of primary and supporting responsibilities in the areas of investment analysis, performance monitoring, supplementary fund due diligence, asset allocation and research.

Mitchell holds a Bachelor of Science (majoring in Statistics) and a Bachelor of Commerce (majoring in Management Science) from the University of Canterbury.

Mitchell is a candidate in the CFA® program and is bound by the CFA Institute’s Code of Ethics and Standards of Professional Conduct

Ben Brinkerhoff

Head of Research

Ben has a background in wealth management. Prior to moving to New Zealand, he was Chief Operating Officer at Index Fund Advisors, an advisory firm with $2.2 billion of funds under advice. His career has also seen him undertake the role of senior economic consultant, and economic manager for the Qatar Economic Free Zones.

Ben’s main role is to facilitate growth and improve efficiency in Consilium partner firms, and help them achieve their strategic initiatives. He is also a member of the Consilium investment committee.

Ben is an Authorised Financial Adviser (AFA) and an Accredited Investment Fiduciary (AIF) and has a BA in History and Economics from University of California.

Prof Ben Marshall

Independent Academic Consultant

Professor Ben Marshall holds the MSA Charitable Trust Chair in Finance at Massey University.

He has undertaken research in areas such as the impact of climate on financial markets, factors that influence stock returns, quantitative approaches to portfolio management, transaction cost and illiquidity measurement, and exchange traded funds. Ben’s research has been published in leading international journals and he is a regular speaker at international finance conferences. He is currently ranked in the top 1% of authors based on downloads of his working papers.

Ben serves on the editorial board of a number of journals and has consulted to public and private companies in a range of different areas.

He is an Independent Academic Consultant, with a particular focus on governance, analytical support and policy review.